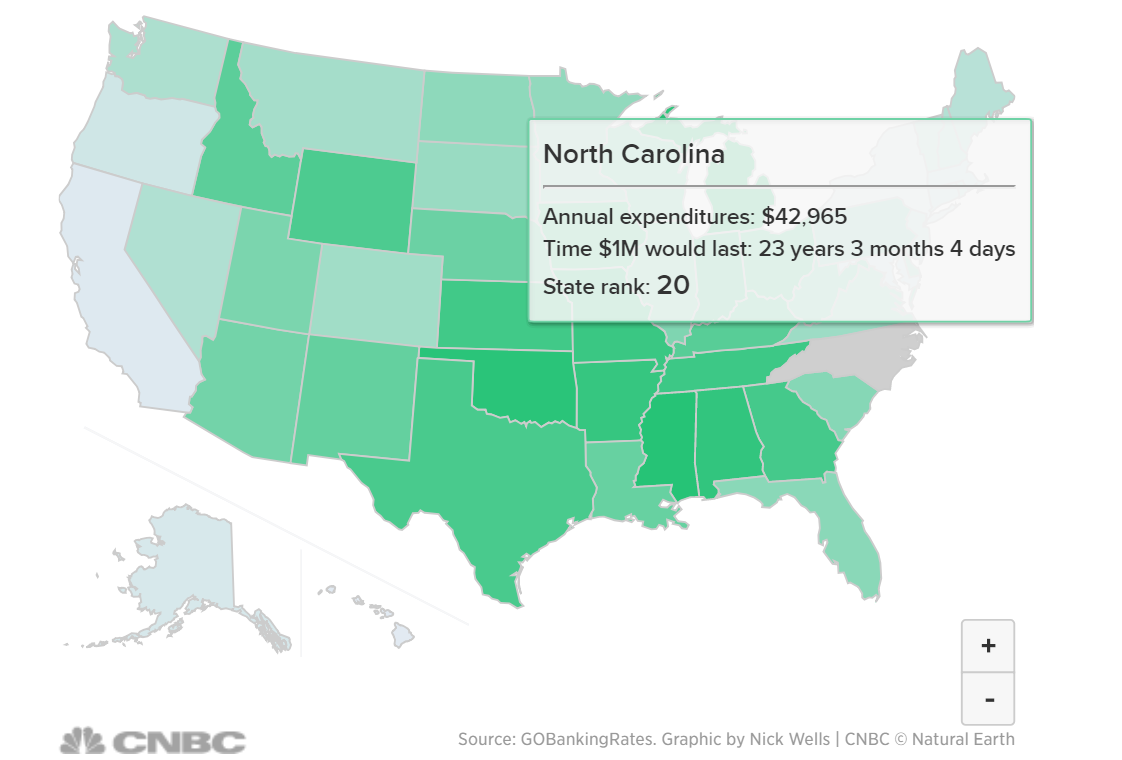

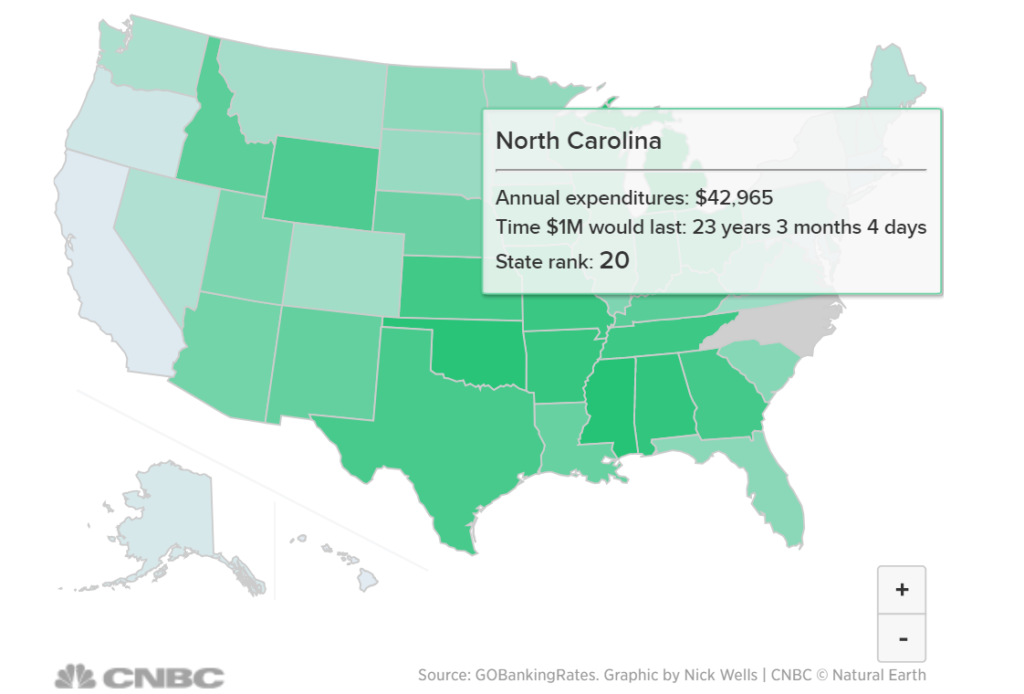

What is 23 years, 3 months, and 4 days? If we were playing Jeopardy, this would be the correct response to, “How long $1 million retirement dollars will last on average in NC?”.

While this is great information to know, you need more information to make this Your Number. To get a better handle in determining ‘Your Number’ for retirement, you will at least need to answer these 3 questions:

- A) How much are average expenses in my state?

- B) Do I spend more or less than this average?

- C) How long will I be in retirement?

The Answers

The answer to question A in North Carolina is $42,965. But you also want to know the responses to questions B and C. Once you know these answers, you will know if you need more or less than $1 million in retirement.

Armed with A, B & C responses, you are homing in on how much you will need in retirement. But you still have other questions you need to answer. One example, “Is the $1 million in a traditional 401K?” If so, you still need to pay taxes (both federal and state in NC) on these funds. Armed with these answers, you now have a good preliminary target of how much you need for retirement (Your Number).

If you need help determining Your Number or would like a more detailed analysis of Your Number (i.e., the impact of when you take Social Security on Your Number), you can contact Stalwart Financial Planning.