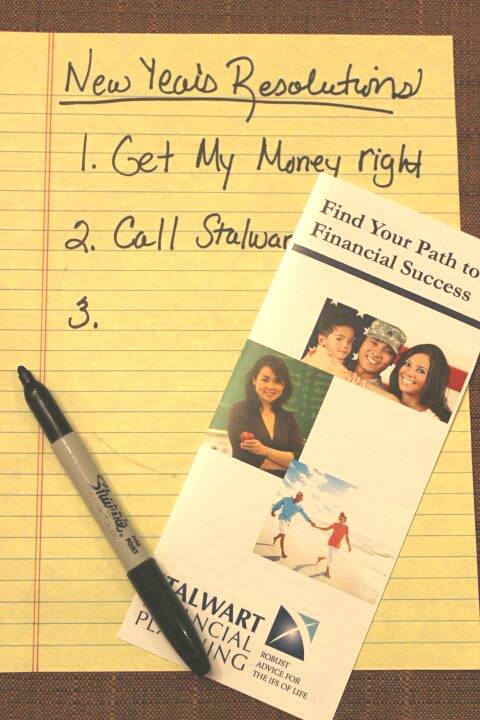

Have you already made your New Year’s resolutions? Since many of us make resolutions this time of year, I have identified three that you should keep in the new year:

- Establish an Emergency Fund

- Form an Investment Policy Statement and stick to it

- Create a Budget and use it

1. An emergency fund is like having a fire extinguisher in your kitchen. You hope you never need it, but in case you do, you want to know it is handy and fully charged. Your emergency fund should be 3 to 6 months of after tax living expenses (6 to 9 months if you are self-employed). Added portfolio risk is one of the issues that can be caused by lack of an adequate emergency fund. Some of you might be asking, “How does this add risk?” Risk is added, by the fact you might have to sell investments during a temporary dip in price to cover an emergency expense. If this happens, then changes to your portfolio are not directed by your investment policy, but more by whether or not you need to replace the heating system in your home.

2. Investors form Investment Policies; otherwise, they are just stock pickers. The framework for building and maintaining portfolios is the investment policy. This policy should contain more than just a simple ratio of stocks to bonds. The policy should have the percentages for each of the asset classes you are using in your portfolio. Here are a few example asset classes:

- Fixed Income: Short Term Bond, Intermediate Term Bond, Long Term Bond

- Equities: Large Cap Stock, Small Cap Stock, International Stock, Developing Nations Stock

- Cash

Now with your investment policy statement in place, the next time you get a hot tip from your Uncle Thomas’ friend, you can determine if it really fits into you portfolio or not.

3. I highly recommend that you create a family budget. Your budget should include all income, expenses, and saving goals for the month. Having a family budget allows us to determine each month how we are doing. In my opinion, creating the family budget is the easy part, or about 30% of the work. The remaining 70% (the hard part) involves sticking to your budget. In America, each person is bombarded by more than 3,000 marketing messages every 24 hours. It is no wonder that sometimes we are persuaded to transform wishes into needs. Without a budget as a compass, it can be difficult to stay on course and not be enticed by slick marketing hype.

What are some of your New Year’s resolutions?

###