Images of volatility often come to mind when we think about the impact of political dynamics on the stock market. However, a deep dive into the returns of the past century of the US stock market offers a different perspective.

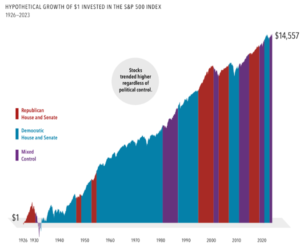

Let’s consider a graph depicting the growth path of the US stock market from 1926 to 2023. The data, laid out alongside the political control of the House and Senate, reveal an interesting pattern: overall, stocks have trended higher, regardless of whether Democrats or Republicans were at the helm or whether power was evenly divided.

Does that mean political events have no bearing on the stock market? Not entirely. Congressional actions can indeed sway returns, but they operate in a complex arena where numerous other factors, such as geopolitical developments, interest rate fluctuations, and technological innovations, are also at play.

Investors should remember to invest in companies that strive to serve their customers and grow their businesses irrespective of Washington’s political climate. Therefore, it is advisable not to base investment decisions solely on the control of Congress.

The graph, showing hypothetical growth from a $1 investment in the S&P 500 Index from 1926–2023, depicts stocks trending higher under many political conditions. The values reach a whopping $14,557 under varied political control, Republican House and Senate, Democratic House and Senate, and Mixed Control.

It’s important to underscore that past performance doesn’t guarantee future results, and the S&P 500 index does not indicate any specific investment. However, the general trend clearly shows that disciplined investors are often rewarded, regardless of who presides in the House and Senate.

In conclusion, keeping your investment strategy flexible, adaptable to multiple variables, and not solely aligned to political control in Congress would be the way to navigate the equity market effectively. Faith in companies’ intrinsic strength, growth potential, and customer commitment can steer your investment journey to higher rewards.