Can you help me time the market? This is a question I got recently. Those of you who have been viewing my blogs already know my answer to this question, but for those of you who are new sit back and listen to my rant.

I do not think I or anyone else can consistently time the stock market. You will hear people say they called the great recession. This might be true, but how many times did they call for a major down turn prior to the great recession and how many times have they called it since? History has taught us that being invested in the stock market has rewarded investors over the long haul. With this being said, I do not think investors should try to time the market, but instead should always be invested in the market with a portfolio that is congruent with their financial objectives.

Click below to play video

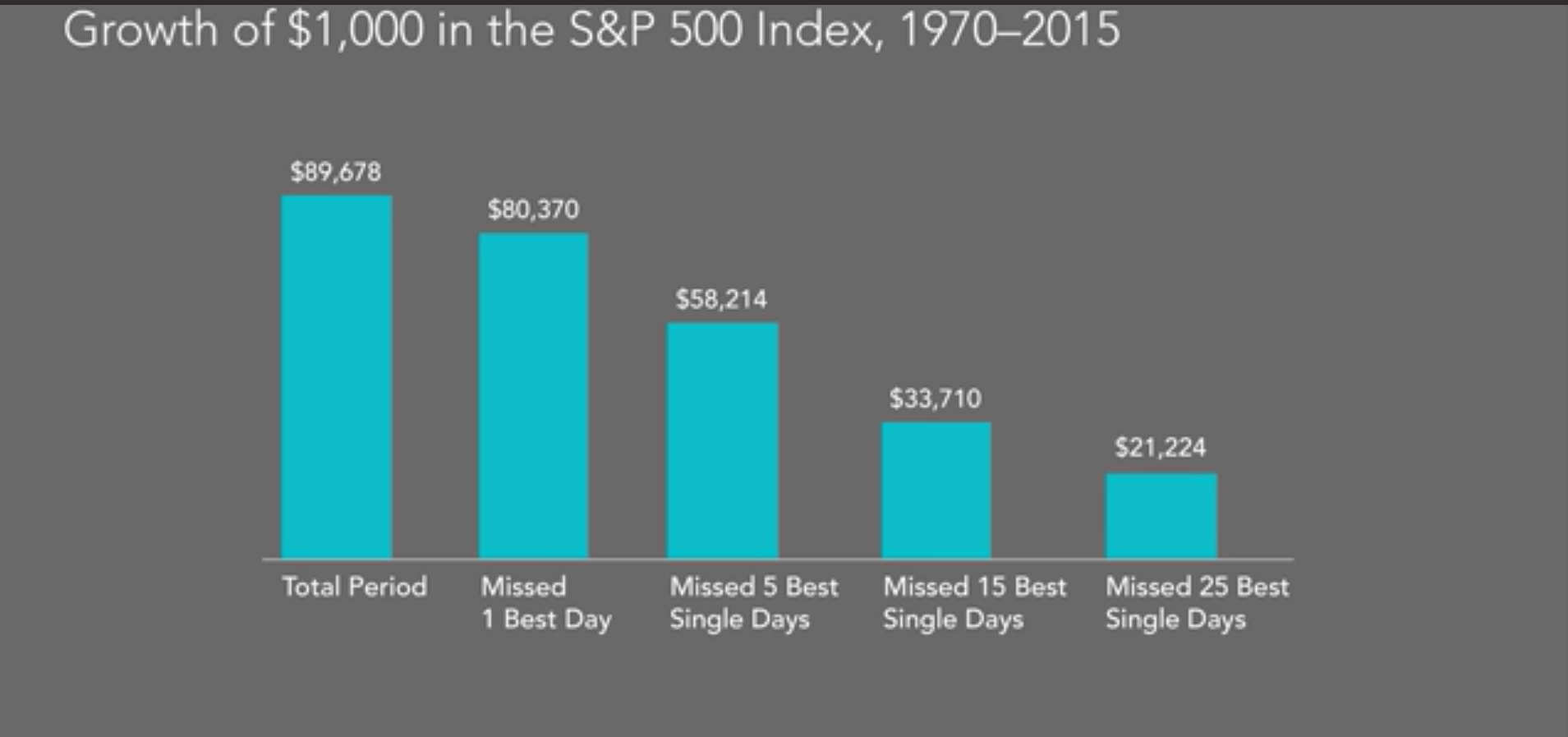

The reasons why I think you should always be invested is because you never know when the next big up day in the market is coming. If you had invested $1,000 into the market (S&P 500) in 1970, these funds would have grown to $89,678 by the end of 2015. But if you missed out on the 25 largest days in the market, you would have missed out on 76.3% of the return and only earned $21,224. To put it another way, by trying to time the market your returns might look like this:

$1000 investing in S&P 500 from January 1970 through December 2015 returns[1]

- $89,678 – if fully invested everyday

- $80,370 – if missed 1 Best day

- $58,214 – if missed 5 best single days

- $33,370 – if missed 15 best sing days

- $21,224 – if missed 25 best single days

The above example can be applied to your investment portfolio. By staying fully invested in a portfolio that meets your investments objectives, you can generate better results than trying to time the market.

Most of us need to take some risk to get the returns needed to be able to reach our financial goals. I hope you can see from the above example. The risk you take should not be in trying to time the stock market.

[1] In US dollars, indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance data from January 1970 – August 2008 by CRSP, performance data from August 2008 – December 2015 provided by Bloomberg. S&P data provide by Standard & Poor’s Index Service Group, US Bond and Bills data © Stocks, Bonds, Bills and Inflation YearbookTM Ibbotson Associates, Chicago, regularly updated work by Roger G Ibbotson and Rex Sinquefield