Is your financial portfolio lost in the wilderness? Does it feel like your portfolio has taken a short cut to nowhere? This is the feeling many do-it-yourselfers get when they put together their own portfolios.

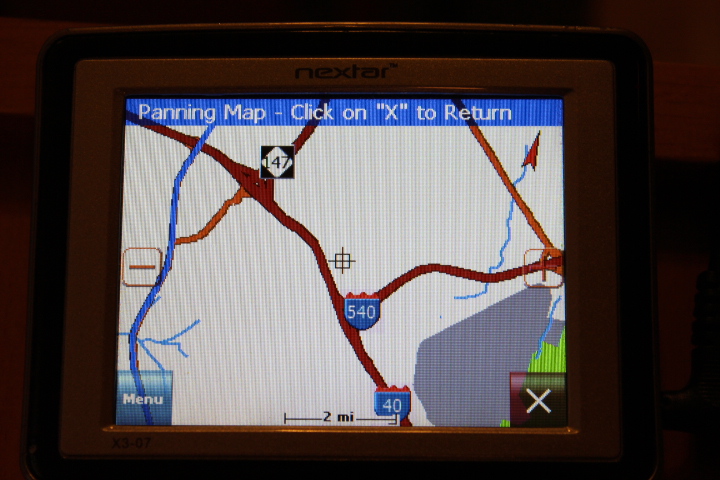

Their portfolio makes them feel like they are meandering through the back sections of the Great Dismal swamp. The reason for this feeling is that they did not use an Investment Policy Statement (IPS) when putting their portfolio together. An IPS is like a Global Positioning System receiver or GPS. An IPS keeps your portfolio on track. It keeps your portfolio working toward your goals. Moreover, when you get off course, it acts as a GPS and directs you back to the route you need to be following.

You are probably asking, what is an IPS. An Investment Policy Statement is simply writing down the asset allocation that gives you the best chance of reaching your financial goals. Here is an example:

|

|

| Large Cap Growth |

10% |

| Large Cap Value |

12% |

| International – Developed |

8% |

|

… Asset Allocation 4… |

XX% |

|

… Asset Allocation 5… |

YY% |

|

… Asset Allocation 6… |

ZZ% |

| Short Term Bond |

12% |

| Cash |

4% |

| Total |

100% |

Depending on where you are in your life, just starting out, thinking of retirement, or planning a gifting strategy, your IPS will be different.

An IPS keeps you on course in three ways:

- Provides guidance when adding new portfolio positions

- Provides clear direction when re-balancing

- Provides warning if you fall in love with a single investment

If you have an IPS, it gives you direction when you look to add that next hot stock tip you got over lunch. For instance if this hot tip is a Large Cap Growth stock and you are already over your asset allocation target for Large Cap Growth you have two choices.

- Do not buy this new hot tip

- Sell enough of your Large Cap Growth position to allow you to purchase the hot tip

As you can see, an IPS works like a GPS by keeping your portfolio allocations on course.

Another way your Investment Policy Statement GPS keeps you on track is when it comes to re-balancing. Most of us have heard we need to re-balance at least annually, but many fail to do this. If you have a written IPS, it is easy to see how your portfolio has moved and you can quickly use the IPS as a GPS and get back on course.

Many do-it-yourselfers can fall in love with one stock or mutual fund. This position can start to take over their portfolio. By having an IPS, it is easier to manage your portfolio based on the facts. In other words, when ACME Computers becomes 33% of your portfolio, you can tell it is time to trim some of this position no matter how much it has gone up.

Get on Course

Now go ahead and write out your Investment Policy Statement today. If you need some help, you should contact a Fee-Only Financial Advisor such as me to assist in putting your Investment Policy Statement together.

Is your portfolio’s GPS working?